Time to Evaluate.

- walter@itmakes-cents.com

- Aug 20, 2021

- 1 min read

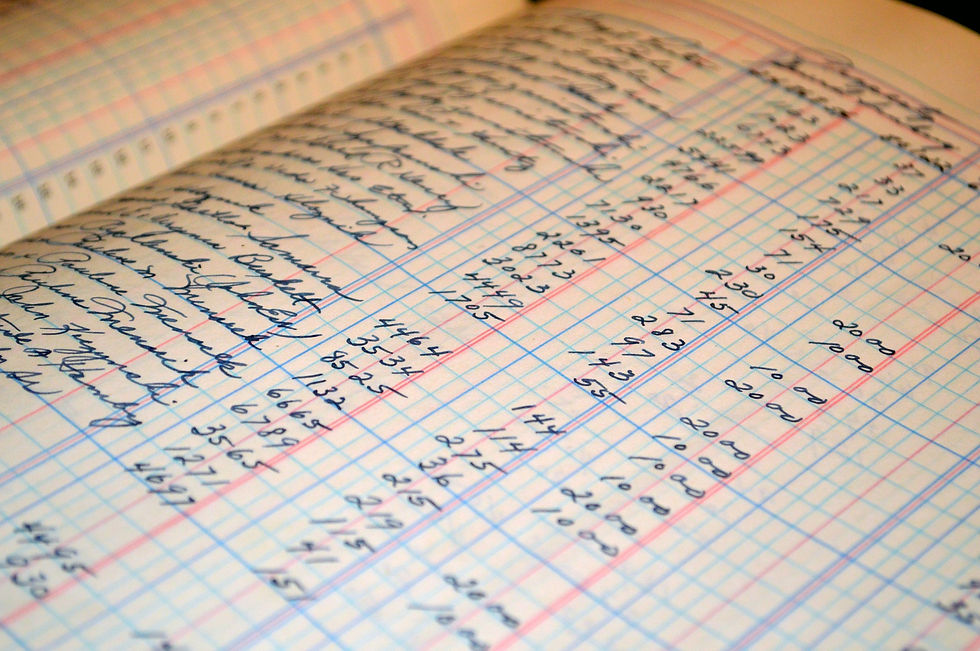

Evaluate. This is step 2 into B.E.L.I.E.V.E.ing in yourself. This is where things can get tricky or even emotional as you start digging into your numbers. Sometimes the reality of how you got here to this point or wondering how you spent so much and have nothing to show for it can feel overwhelming. But just breathe. It’ll be ok. You are here for a reason- you’re ready to make a change. So now it’s time to list all your debts and all your assets. I recommend using Google docs or Excel, they both have a lot of premade options that will work for most beginners. At the early stages of your money journey, I am not a fan of focusing on net worth- more than likely you’ll have a negative number, and this will just add to your stress. Below are some categories that should be listed as you fill out the forms.

Debts- I prefer to list these from lowest balance to highest balance

Examples: Credit cards (create line for each one), cell phone installments, all vehicle loans, mortgage, home equity loans, medical bills, settlements owed, IRS bills, student loans, personal loans, payday loans, any money owed to friends/family

Assets- I prefer to only list things that have a definitive value. Cars, Furniture, collectibles aren’t typically worth what you think they are.

Examples: Home equity, Cash in your accounts, Cash on hand, 401k/IRA balances, Investment accounts, savings bonds,

Comments